A Private Equity Portfolio Company: Changes are Big and Fast

Private equity portfolio companies form a growing part of the Dutch economy. However, much leadership advice is still based on CEOs of publicly traded companies, without considering the unique dynamics of private equity. Investors often have goals that impose different demands on a private equity CEO. “It’s not private equity as a shareholder per se that makes the difference, it’s the expected scale and speed of change,” explains Lars de Jonge of Rivean Capital. “How the employees of the organization deal with private equity as a shareholder depends on the amount of change needed in the company, whether that is positive or negative change. There are companies that are dysfunctional and unsuccessful, thus requiring transformation, but there are also companies where you are going to accelerate growth enormously. You need an emotionally intelligent CEO to lead change and bring employees along.”

Selecting the right CEO for a private equity environment means more than appointing a competent manager or a charismatic public face. “The company’s leadership team is one of the biggest success factors,” says Lars. When a CEO successfully meets the challenges of the private equity environment, their influence is significant. We know that the best 25% of CEOs deliver shareholder returns at least 9% higher than other CEOs, and possibly up to 16% higher, depending on the industry.

How Do You Know as an Investor if the Right Top Team is in Place Before You Buy a Company?

“It is probably correct that private equity as a whole replaces the top team of a portfolio company faster and more often than companies with other types of owners,” says Lars, “but it is never the starting point and very much depends on the type of private equity firm. We often invest in companies because we believe in the existing leadership team; but as a company grows and changes, the management will also need to change, sometimes by developing the skills of the current team and sometimes by adding new skills and insights from outside.”

A good private equity firm will naturally have done its due diligence, but buyers do not have unlimited time or resources. Lars: “You are dealing with time pressure and competition from other parties. Ultimately, private equity firms, like everyone else, must make decisions on leadership based on limited information. It is one of the most difficult aspects to analyze from the outside. Ideally, investors would like to ask the existing leadership to do pre-deal assessments to get a view of their leadership. However, this would be time-consuming and mainly risk sending the wrong message to the current CEO and team. That same team often decides who the buying party is. I don’t think private equity has yet figured out exactly how to conduct ‘due diligence’ for the C-level. Operational, commercial, legal, financial; that is now all fairly standardized. But assessing whether you have the right team is very difficult.” Both the investor and the C-level team can thus have uncertainty on this theme at the start.

Uncertainty After the Acquisition

New ownership brings at least some uncertainty for ordinary employees for some time. We know from research that concerns about job security can severely impact employee satisfaction after a private equity acquisition. “People generally do not like change,” says Lars, “even if it is positive change. The type of private equity firm and its reputation will influence how much concern an acquisition causes. If it is a restructuring or ‘distressed’ private equity, they can be very rigorous,” says Lars, “but if it is a growth-oriented private equity firm, the changes are perceived more positively.”

However, Lars also warns against overestimating employees’ concerns about new owners. “From the outside, I thought there would be a bigger difference, but most employees, in my opinion, do not actually experience significant changes when a growth or buy-out equity fund comes on board. These companies are interesting because they have shown healthy growth, and we at Rivean want to continue those trajectories. There are always and rightly so, employees with concerns. A CEO must be attentive to this.”

Empathy as a Core Skill for the PE CEO

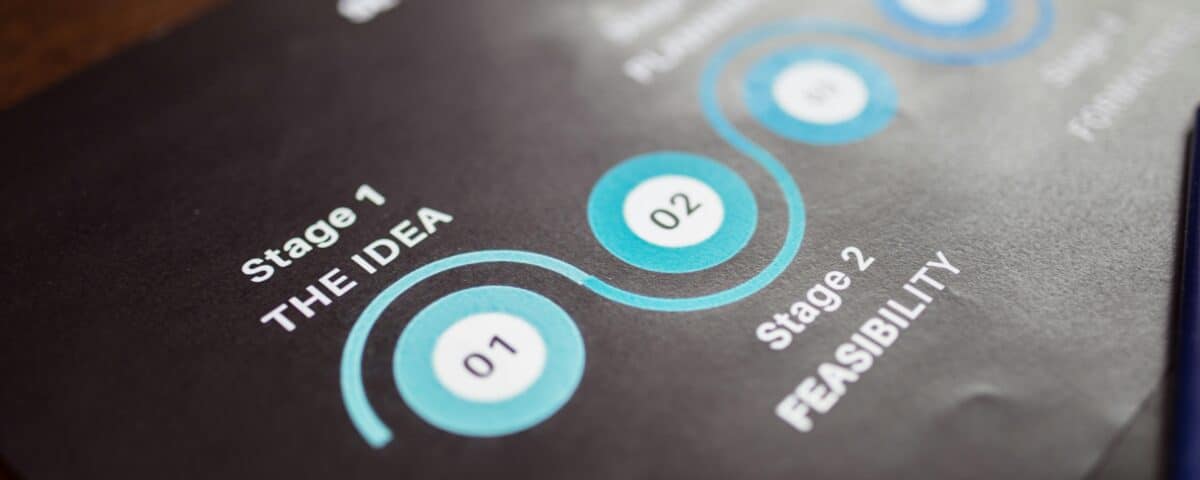

When an investor buys a company, they know two things for sure:

1. Change is difficult, and the required amount and speed of it are not always clear in advance, and employees generally do not like change.

2. It is not always easy to get a good view of the qualities of the top team and particularly the CEO in advance.

What core competency should therefore be addressed in the assessment of the CEO’s qualities during the due diligence phase? Empathy. As early as the 1990s, research suggested that poor, unaligned communication after an acquisition could suppress morale and negatively impact business performance. Recent research shows that employees who have a clear understanding of the purpose and goals of their organization also evaluate their company’s performance more positively. Being able to empathize with the feelings, needs, and interests of your employees (sometimes on an individual level and always on an organizational level) is crucial. Empathy, therefore.

Lars indicates in this context that he sometimes evaluates his CEOs of portfolio companies in terms of how well they are as “storytellers.” This storytelling ability helps them get their team on board and keep them on board during various changes: “At one of our portfolio companies, the growth rate has been thirty percent per year, and it will remain so, so we need someone who can constantly excite people about the changes that come with that kind of growth. A good storyteller is empathetic. The greater the change they have to lead, the more important that is.”